Our Partners

& Exclusive Industry Research

The Millennium Alliance is a leading technology and business educational advisory firm with the sole mission of helping to transform the digital enterprise. Through our executive education platform, peer-to-peer learning model via our senior-level Assemblies, exclusive research projects conducted with Ivy League academic institutions, and our numerous digital properties, we have become a trusted source for real-world tangible learning and engagement opportunities for senior executives and their technology partners.

Digital Transformation & Leadership?

When it comes to C-Level focused events, nobody does it better than Millennium, as nobody can provide the access we do with the information we have available. After extensive research into the needs and wants of our membership base, the vast majority of our members expressed their desire to get back to conducting business in a face-to-face environment. By hosting strictly live events, we are able to offer our partners more of what they are craving with exclusive access to our entire community in a format that makes it easy to build relationships.

Launched in 2017, Digital Diary was created to provide premium content to our members interested in digital and business transformation, leadership, and general technology awareness. With senior executive, top academic and analyst contributors, interviews with industry leaders, and digital transformation insights from technology experts, Digital Diary has all of the professional development tools you need to stay ahead of the curve, including the rapidly growing #MillenniumLive Podcast Series.

As a fully accredited member of the National Registry of Continuing Professional Education (CPE), The Millennium Alliance offers on-campus leadership sessions with leading academics, authors, and analysts to help provide the necessary tools for career growth and effectiveness. This is in addition to the sessions hosted on-site at our Assemblies.

Attend our curated events to meet and grow with like-minded executives in your field.

- Chief AI Officer

![arrow]()

![arrow]()

- Chief Customer Experience Officer

![arrow]()

![arrow]()

- Chief Data Officer

![arrow]()

![arrow]()

- Chief Digital Officer

![arrow]()

![arrow]()

- Chief Human Resources Officer

![arrow]()

![arrow]()

- Chief Information Officer

![arrow]()

![arrow]()

- Chief Information Security Officer

![arrow]()

![arrow]()

- Chief Marketing

![arrow]()

Officer![arrow]()

- Chief Medical Information Officer

![arrow]()

![arrow]()

- Chief Medical

![arrow]()

Officer![arrow]()

- Chief Merchandising Officer

![arrow]()

![arrow]()

- Chief Nursing Officer

![arrow]()

![arrow]()

- Chief Revenue Officer

![arrow]()

![arrow]()

- Chief Supply Chain Officer

![arrow]()

![arrow]()

- Chief Talent Officer

![arrow]()

![arrow]()

- Patient Experience Officer

![arrow]()

![arrow]()

- SVP of Benefits

![arrow]()

![arrow]()

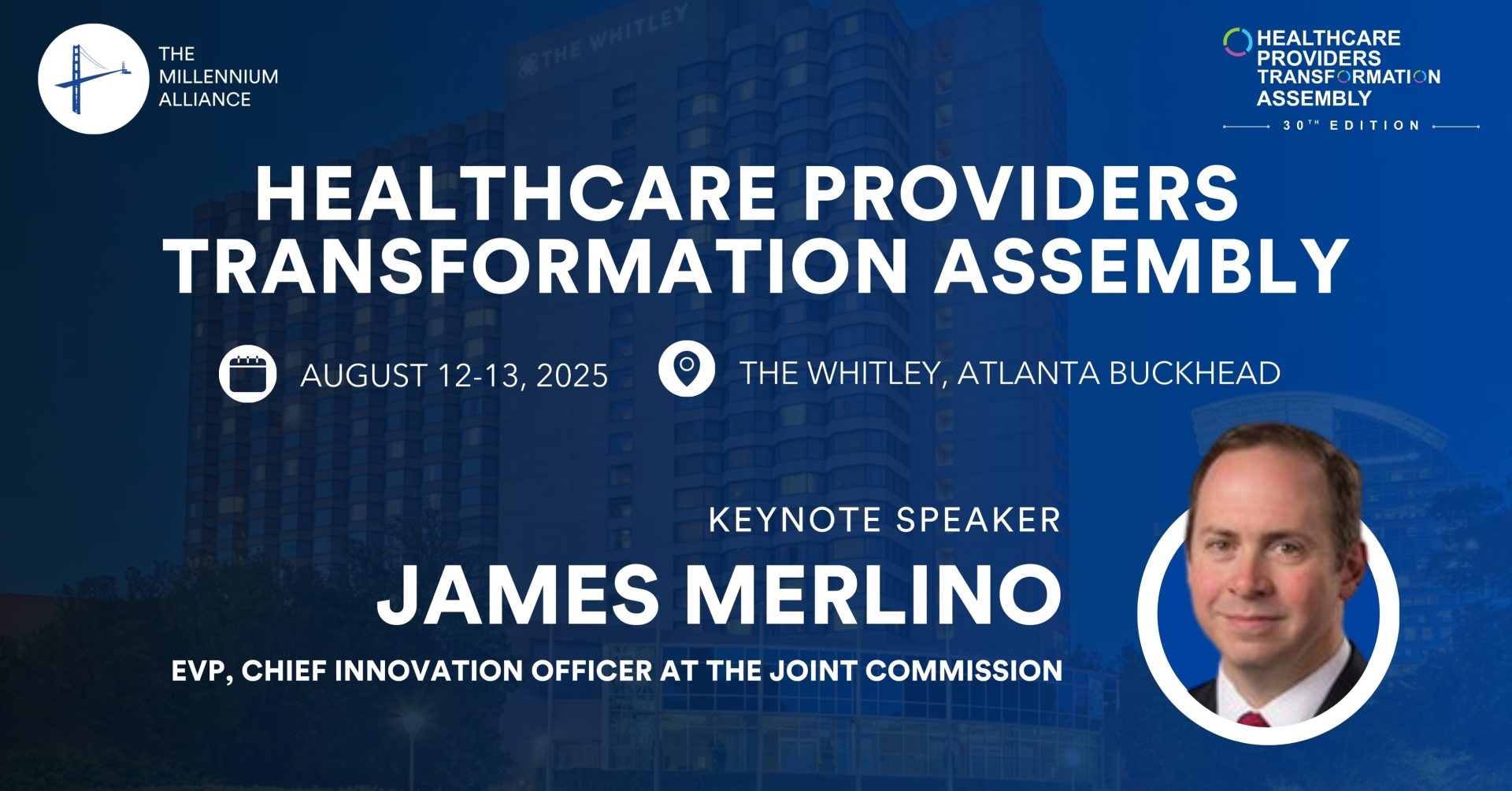

Featured Thought Leaders

Millennium Alliance Membership

In the midst of disruption across all industries, our members are given the tools they need to digitally transform their enterprises.

What does it mean to be a

Millennium Member?

Joining Mill-All is an opportunity unlike any other to connect with the best professionals in your industry and be a part of a community to become the best leader you can be.

500 Companies Attend Each Year

Hear from our current members about how The Millennium Alliance community has impacted their lives.

![video poster]() 2024 Delegate Experience | Marketing, Retail & AI

2024 Delegate Experience | Marketing, Retail & AI![video poster]() 2024 Delegate Experience | Human Resources, Benefits, & Talent Acquisition

2024 Delegate Experience | Human Resources, Benefits, & Talent Acquisition![video poster]() 2023 Delegate Experience | Healthcare

2023 Delegate Experience | Healthcare![video poster]() 2023 Delegate Experience | Supply Chain & Retail Innovation

2023 Delegate Experience | Supply Chain & Retail Innovation![video poster]() 2023 Delegate Experience | Cybersecurity

2023 Delegate Experience | Cybersecurity![video poster]() 2023 Delegate Experience | Data & Technology

2023 Delegate Experience | Data & Technology![video poster]() 2022 Delegate Experience | Marketing, Retail, & Customer Experience

2022 Delegate Experience | Marketing, Retail, & Customer Experience![video poster]() The Millennium Experience | Members & Partners

The Millennium Experience | Members & Partners

Take the next step to learn more about us,

or reach out today.